FINANCIAL AUDIT: KNOW EVERYTHING ABOUT AUDIT

FINANCIAL AUDIT: WHY AND HOW TO PERFORM IT?

29/12/2023

What is a Financial Audit?

Exploration of Strategic Financial Decisions:

The financial audit thoroughly analyzes the strategic financial decisions made by the company. It evaluates its investments, acquisitions, and resource allocations with the aim of assessing consistency with long-term objectives. The audit allows the company to be guided towards judicious financial choices in order to strengthen its position in the market.

Financial Risk Management:

Risk management turns out to be a crucial element of financial auditing. It ventures into the risk management policy, determines the potential risk factors, and analyzes the resilience of the company in the face of these risks. It therefore makes it possible to strengthen the financial stability of the company, but also to prepare it so that it can face possible volatile economic conditions.

Optimization of Cash Management:

Cash management is also a main component of the financial audit. The latter analyzes payment cycles, cash flow, and credit policies. By identifying various opportunities, it enables cash flow optimization and ensures the liquidity needed to support daily operations as well as growth initiatives.

Strengthening Financial Credibility:

Finally, the crucial aspect of financial auditing: strengthening the financial credibility of your company. The audit examines financial reports, financial analysis indicators, and compliance with accounting standards. By ensuring legal financial practices, the audit strengthens the confidence of investors and partners.

Why carry out a Financial Audit ?

Financial auditing is the cornerstone of corporate governance. It answers the following fundamental questions: “Are our financial situation and its practices consistent with standards, consistent with our objectives? Are they conducive to growth?” The initial objective of the audit is to confirm the reliability of the financial information provided by the company in order to define adequate recommendations.

The financial audit takes an in-depth look at financial statements, accounting policies, and financial risk management. More than a simple audit, it offers a critical assessment of the company’s strategic financial decisions. The audit strengthens the credibility of financial reports and helps prevent possible irregularities. Likewise, it prepares the company for long-term financial success by improving management, minimizing risks and recommending financial optimization strategies.

Internal Tools for an Audit

Accounting Software:

Accounting software is the backbone of financial auditing. They enable the generation of financial reports, visualization of cash flows, and ensure compliance with various accounting standards.

Cost Analysis Tools:

Cost analysis tools allow better visibility on the different cost families within your company. The study of operational costs, fixed and variable costs allows the identification of areas where savings can be made by optimizing its management, as well as the possibility of defining its profitability threshold.

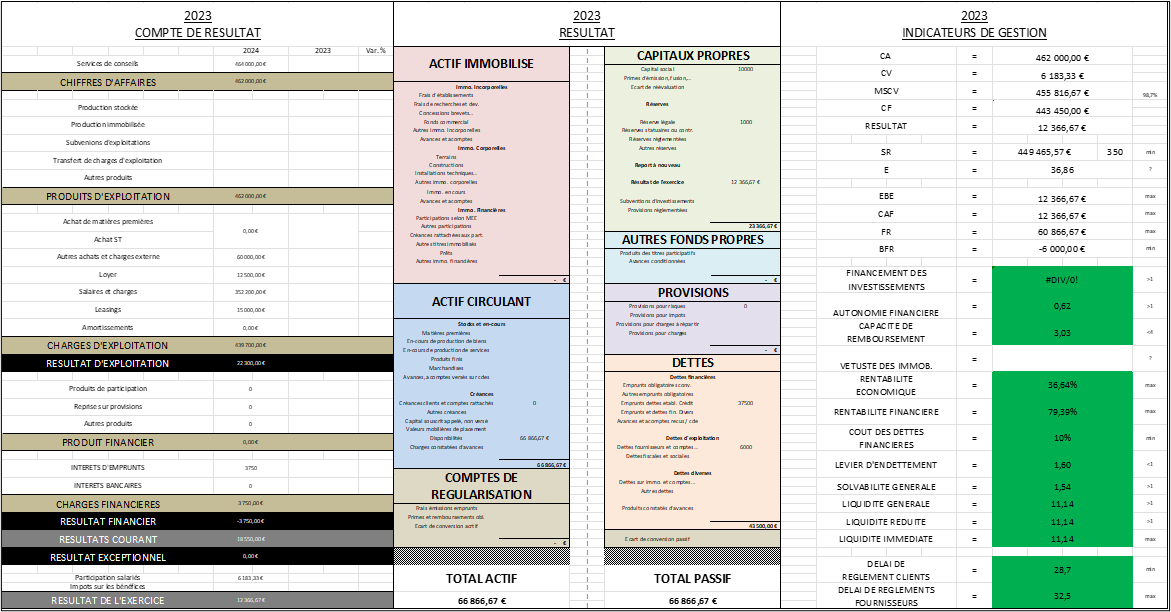

Financial analysis :

Financial analysis makes it possible to assess the short and medium term health of the company. It identifies profitability, liquidity ratios and helps guide recommendations in order to optimize cash management and its investments.

Financial indicators for an Audit

Gross and Net Margin:

Gross and net margins measure the profitability of the company. The financial audit analyzes these indicators in order to evaluate the financial performance of the company, identify excessive costs, then propose adjustments.

Liquidity and Solvency:

Financial auditing analyzes liquidity and solvency through numerous indicators such as the solvency ratio, the general liquidity ratio, the immediate liquidity ratio, the debt ratio, etc.

BFR and cash flow:

Operating cash flow assesses a company’s ability to generate cash through its operating activities. The Working Capital Requirement determines the cash flow required to enable the proper functioning of the company.

Why choose PATUREL CONSULTING to carry out your Audit?

PATUREL CONSULTING is the ideal partner for your audit because of our financial expertise and resource and investment management. We work rigorously to analyze the financial health of your business, identify different optimization opportunities and strengthen your profitability. By working with our firm, you will benefit from a practical approach to auditing, which will guarantee solid financial management.